REAL TIME NEWS

Loading...

Gauging the Impact of Larger Tax Refunds on Equity FlowsSeasonal Trends in US Equity Fund InflowsHistorically, US equity fund inflows experience a notable uptick during tax refund season, which spans from mid-February to mid-April. This period typically accounts fo...

Gauging the Impact of Larger Tax Refunds on Equity FlowsSeasonal Trends in US Equity Fund InflowsHistorically, US equity fund inflows experience a not

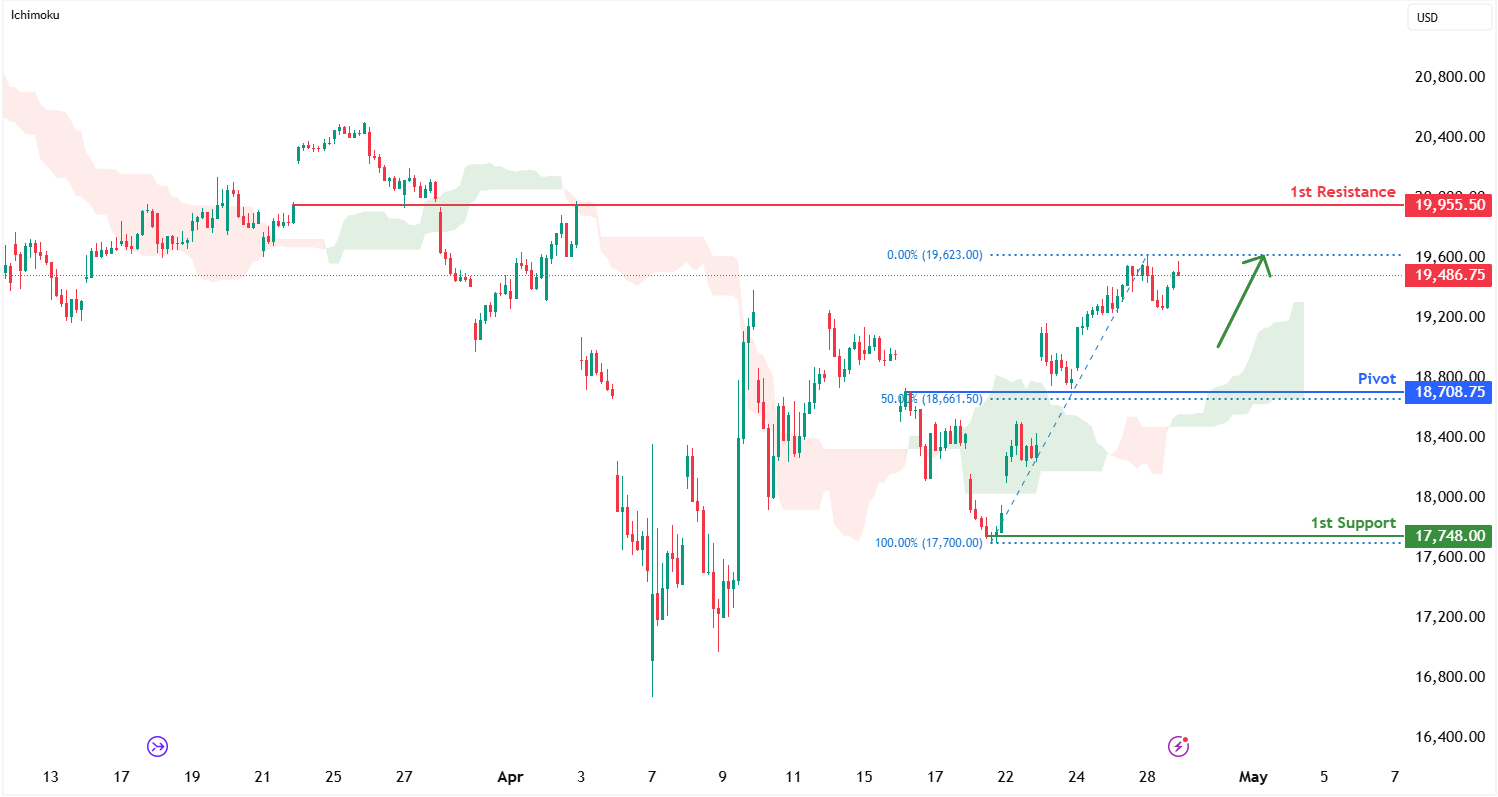

SP500 LDN TRADING UPDATE 18/2/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6925/35WEEKLY RANGE RES 6980 SUP 6720FEB EOM Straddle indicates a range of 214.6 points, suggesting a monthl...

SP500 LDN TRADING UPDATE 18/2/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEA

Title GBPUSD H4 | Bullish bounce off key support Type Bullish bounce Preference The price is reacting off the pivot at 1.3549, an overlap support. A bounce from this level could lead the price toward the 1st resistance at 1.3640, a pullback resistance. Alternative ...

Title GBPUSD H4 | Bullish bounce off key support Type Bullish bounce Preference The price is reacting off the pivot at 1.3549, an overlap support. A b

Daily Market Outlook, February 18, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…US stock futures edged higher alongside gains in Asian markets, suggesting a cooling off after recent declines fuelled by concerns over artific...

Daily Market Outlook, February 18, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…US stock futures edged highe

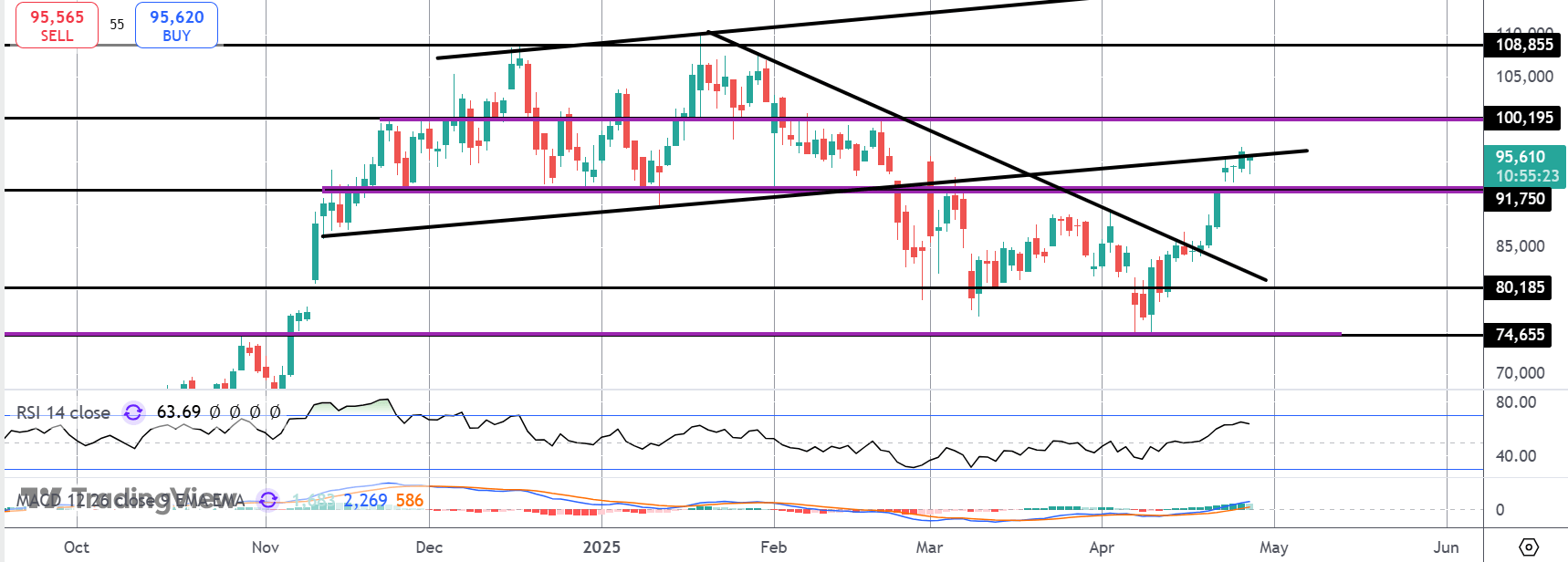

VWAP Swing Strategy Update 18/02/26In this update, we review the latest alerts and positions for the VWAP swing strategy. To review today's video update, click here!...

VWAP Swing Strategy Update 18/02/26In this update, we review the latest alerts and positions for the VWAP swing strategy. To review today's video

Title USOUSD H4 | Bullish bounce off overlap support Type Bullish bouncePreference The price is falling towards the pivot at 61.61, an overlap support that is slightly below the 61.8% Fibonacci projection. A bounce from this level could lead the price toward the 1s...

Title USOUSD H4 | Bullish bounce off overlap support Type Bullish bouncePreference The price is falling towards the pivot at 61.61, an overlap support

Title AUDUSD H4 | Bullish continuation in play Type Bullish bounce Preference The price has bounced off the pivot at 0.7031, a pullback support that aligns with the 50% Fibonacci retracement. A rise at this level could lead the price toward the 1st resistance at 0....

Title AUDUSD H4 | Bullish continuation in play Type Bullish bounce Preference The price has bounced off the pivot at 0.7031, a pullback support that a

Title USDCHF H1 | Bearish drop off Type Bearish drop Preference The price has rejected off the pivot at 0.7743, which is a pullback resistance. A drop from this level could lead the price toward the 1st support at 0.7640, a pullback support. Alternative Scenario I...

Title USDCHF H1 | Bearish drop off Type Bearish drop Preference The price has rejected off the pivot at 0.7743, which is a pullback resistance. A dro

Title EURUSD H4 | Bullish bounce off pullback support Type Bullish bounce Preference The price is falling towards the pivot at 1.1834, which is a pullback support that aligns with the 61.8% Fibonacci retracement. A bounce from this level could lead the price toward...

Title EURUSD H4 | Bullish bounce off pullback support Type Bullish bounce Preference The price is falling towards the pivot at 1.1834, which is a pull

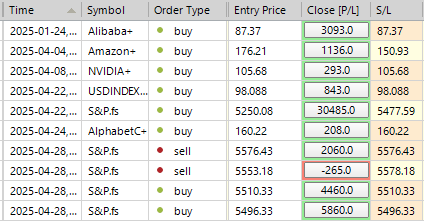

Title USOUSD H1 | Falling towards 50% Fib support Type Bullish bouncePreference The price could fall towards the pivot at 63.15, a pullback support that aligns with the 50% Fibonacci retracement. A bounce from this level could lead the price toward the 1st resistan...

Title USOUSD H1 | Falling towards 50% Fib support Type Bullish bouncePreference The price could fall towards the pivot at 63.15, a pullback support th

.png)